BofA has had to step up and deliver a huge chunk of gold (5k contracts). The House account activity shows more stress in the market. Without the cash settlement, this would have been the biggest June since the blowout delivery volume in 2020.

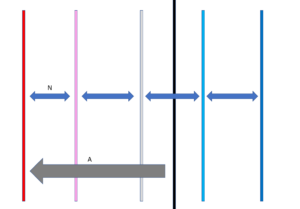

This is roughly $740M which will bring this year close to the last two years from a notional delivery perspective. These contracts held on for delivery and then immediately cash settled.Įven with the cash settlement, there are still 3700 contracts remaining of open interest. Keep in mind also, these contracts could have rolled the day before but decided not to. But that was a minor month and most likely driven by BofA… potentially in an effort to prepare for the June delivery month (more on this below). Ironically, this is also the opposite of what happened last month. Why have so many contracts cash settled? Most likely because it’s getting harder to deliver physical metal. The next highest day was last December when 1373 cash settled. On the first day alone, over 2600 contracts cash settled. So far, the number of contracts that have cash settled has reached a new record. This month, it has started as a headwind. Historically, this has been a tailwind for greater delivery volume. One factor that can drive total delivery volume is mid-month activity. It’s below April but is still early in the contract.įigure: 1 Recent like-month delivery volumeĪs shown below, the amount on First Position was actually the highest since last August which should lead to high delivery volumes.įigure: 2 24-month delivery and first notice Buying Gold & Silver with CryptocurrencyĪs expected, gold has turned in a fairly strong start to the month.Buy Gold the Ultimate Monetary Insurance Policy.

0 kommentar(er)

0 kommentar(er)